Conducting Proper Due Diligence in AML Investigations

The BSA Department can be a costly back office operation. BSA often does not generate any revenue, but without an effective program many entities could face fines, consent orders, negative news, and closures. This is why it’s so important that analysts are trained to conduct proper due diligence from the start of an investigation to its end result. This webinar will define due diligence and the benefits when effectively applied in AML Investigations.

- After attending this webinar participants will know:

- What is due diligence?

- Properly addressing and mitigating risks

- Application of risk-based approaches in AML investigations

- Avoidance of aggressive and defensive SAR filings

- Conducting thorough and effective research for your investigation

- Showing support to justify decision for quality reviews and audits

- Writing an assessment to support final decision

- Avoidance of willful blindness

We will cover identifying risks & concerns, applying a risk-based approach to investigations, preventing aggressive and defensive SAR filings, providing support to investigations for quality checks and audits, writing a strong assessment to support your final decision and avoidance of willful blindness.

This presentation will provide the practical steps, especially for new analysts to effectively identify AML risks and concerns and apply a risk-based approach to investigations to avoid defensive SAR filings and unnecessary escalations. Due diligence can sometimes be subjective, this presentation will cover best practices.

- BSA Department Employees

- Quality Assurance/Quality Control Employees in BSA Department

- AML Investigators/Analysts

- Case Investigators/Analysts

- Alert Investigators/Analyst

- Risk Managers

- BSA/AML Officers

- BSA/AML Analysts/Investigators

- SAR Filing Teams

- Compliance Officers

- BSA/AML Personnel

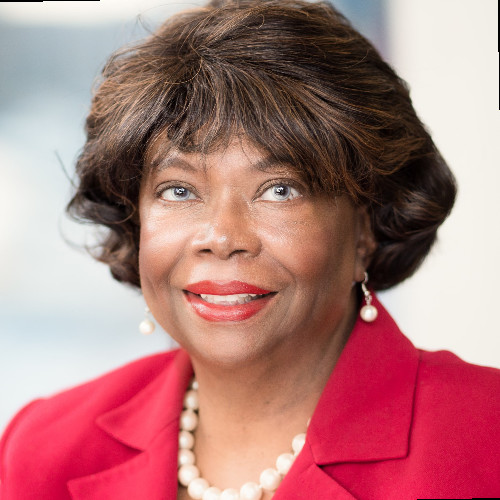

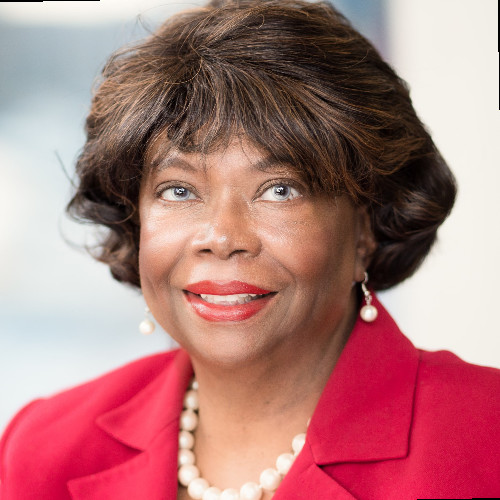

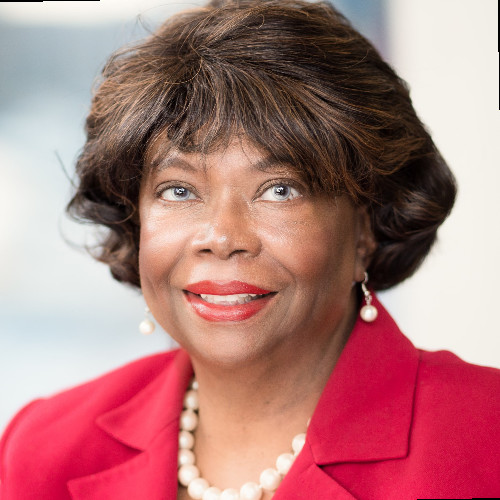

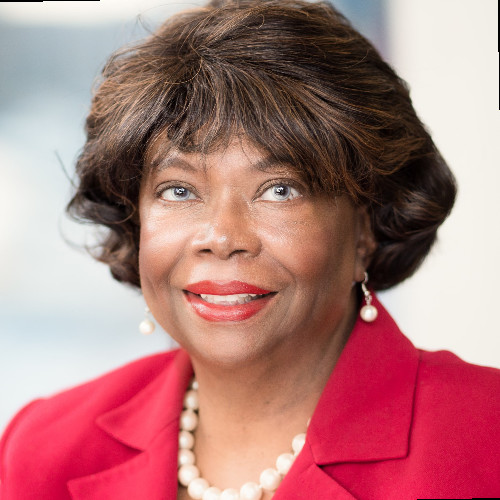

Thamecia Bullard is a Certified Anti-Money Laundering Specialist (CAMS) with over 8 years of professional experience in fraud and AML investigations. She began in the financial services industry holding various positions at a large financial institution. Thamecia has expertise in fraud, specialty fraud, and money laundering- working investigations for retail, credit card, business and individual accounts.

In 2017, Thamecia joined Ameris Bank as an analyst conducting alert level and case level reviews including SAR filings, fraud, complex and continuation SAR filing investigations. At Ameris Bank, Thamecia spent some time being a Team Lead and currently works as a Subject Matter Expert in the AML Investigations department. Aside from working investigations, Thamecia is also a trainer and has experience conducting team and BSA department trainings and workshops on various AML related subjects.

Upcoming Webinars